Developments in artificial intelligence may be the antidote for an aging population, but it takes time for these advancements to work themselves into the fabric of our nation’s businesses. The impact of new developments can persist in markets, so investors need to carefully discern what could be different this time around.

“The four most dangerous words in investing are: ‘this time is different.'” — Sir John Templeton

ARE WE IN A BUBBLE?

While some are drawing parallels between the current period and the late-1990s tech bubble and concluding that a crash may be coming, that’s not our view at all. This market environment is very different given who is leading the charge – the highest quality, most profitable companies in the world – and much lower valuations. Still, we think this history lesson can be instructive. The internet buildout took a number of years to play out, suggesting this buildout and its impact on stock prices may still only be in the early-to-middle innings. A Stanford University professor has some insights we will share later in this commentary.

Now, that doesn’t mean technology stocks are going to continue to surge for years to come. There are many other important factors that matter than just artificial intelligence (AI). A likely path for markets, we believe, is a pullback or mild correction in the second half, offering investors the opportunity to buy on dips. We would not chase this narrow, AI-fueled rally, and maintain our neutral recommended technology allocation.

EQUITIES SHOULD REFLECT AI’S IMPACT ON ECONOMIC GROWTH

Source: LPL Research, Bloomberg, 06/24/24

Data is indexed to 100 as of 12/31/97

Indexes are unmanaged and cannot be invested into directly. All performance referenced is historical and is no guarantee of future results.

Sir John Templeton said “the four most dangerous words in investing are ‘this time is different'” and he was likely talking about long-term investment principles, but sometimes things are truly different over time. Perhaps an equally dangerous phrase is “this time is no different.”

So, let’s compare valuations. In March 2000, the market was trading at a price-to-earnings ratio of 31 based on trailing earnings at that peak, compared to 25 times currently – a big difference. Investors could also compare forward price-to-earnings (P/E) ratios, but with the caveat that estimates were too high at that time. Nonetheless, forward P/Es were 26 then versus 21 currently.

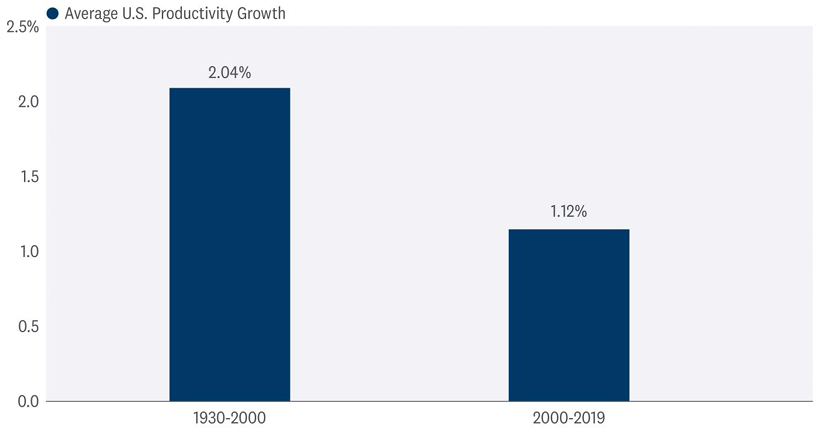

THE PRODUCTIVITY OUTLOOK

One reason to specifically observe developments in disruptive technologies such as artificial intelligence is its impact on productivity. In recent decades, the U.S. has had a decline in average productivity growth, which should not be a surprise as the population ages.

AI COULD GIVE NECESSARY PRODUCTIVITY BOOST FOR OUR AGING WORKFORCE

Source: LPL Research, Bureau of Labor Statistics, Federal Reserve Bank of St. Louis 06/24/24

Productivity growth is the antidote for demographic and inflation headwinds, so we should celebrate firms focused on disruptive technologies able to enhance our work experience. But without an improvement in technology, the recent productivity trend will not likely revert back to the stronger growth of the previous century.

The downshift in productivity has implications for wages, jobs, and living standards. If the technological setup improves, better productivity growth has important ramifications for portfolio managers and investors.

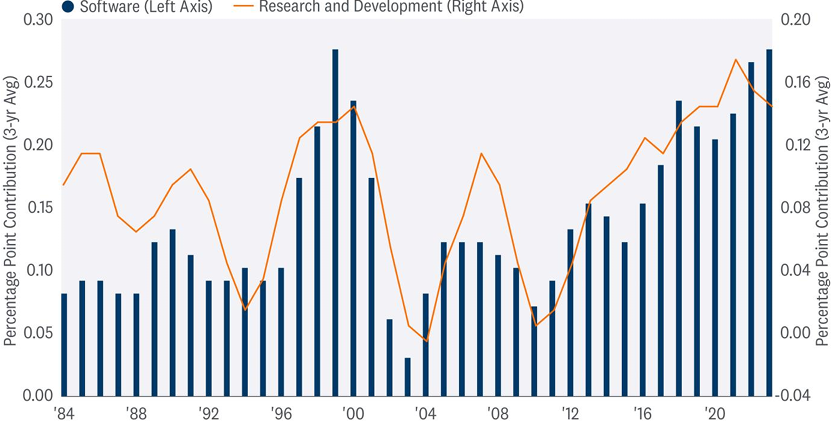

THE NEED FOR PRODUCTIVITY ENHANCEMENTS

Productivity expands as efficiencies and technologies improve, but it takes time. In previous cycles, markets rewarded firms that invested in research and development (R&D) and software. It’s often the case when firms build a commitment to capital investment, the commitment lasts for several years and markets often reward that commitment. For example, the sustained overall contribution to growth from R&D lasted over four years in the late 1990s.

SOFTWARE AND R&D INCREASINGLY MORE IMPORTANT FOR GDP GROWTH

Source: LPL Research, Bureau of Economic Analysis, 06/24/24

Let’s return to the hot topic of AI. The AI boom is a positive for equity markets for several reasons. First, it has sparked a wave of capital investment for companies trying to take advantage of these exciting new capabilities. Second, that investment will likely boost productivity for corporate America, lifting profit margins (more revenue without adding more people). And third, productivity gains allow the economy to grow with less wage inflation, keeping interest rates down and supporting stock valuations. This is the “perfect storm” that drove the massive stock market rally in the late 90s.

“THE DIFFUSION OF NEW TECHNOLOGIES”

The above phrase is the title of a recent working paper at the National Bureau of Economic Research, authored in part by the esteemed Nicholas Bloom of Stanford University.1 He is one worth watching because of his influence on business executives across the country on the role of work in the post-pandemic world.

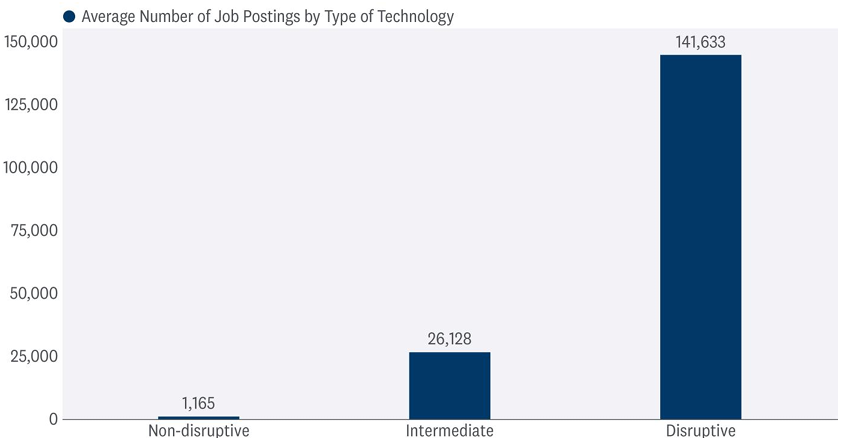

There are a few reasons why business investment in disruptive technologies has a lasting impact on economic growth, productivity, and capital markets. First, new technologies tend to be geographically located at incubators and highly concentrated in just a few regions of the country.

1https://www.nber.org/papers/w28999

As Professor Bloom suggests, a majority of the disruptive technologies are in Silicon Valley and the Northeast Corridor. But eventually, technologies slowly permeate the broader economy. Second, the impact on the job market from new technologies could take “around 50 years to disperse fully” according to Stanford University research. Third, as a technology becomes more standardized within business applications, job openings become available to more than just high-skilled workers, thereby creating opportunities among the broader workforce. In fact, tech advancements from during the baby boomer generation illustrate the persistent impact on job opportunities. Roughly 60% of job titles in recent years did not exist in 1940.2 So instead of thinking AI will shrink the job market, we should rather expect AI to enhance the job market.

Between 2002–2019, highly disruptive technology skills were mentioned in 141,633 job postings on average, whereas the least disruptive skills were rarely mentioned. The point of the research is to show that potentially ground-breaking technology comes out strong and seems to have a sustained impact, even for generations to come. So, it is fair to say interest in ground-breaking tech stocks is here to stay for the long term, despite our belief that market volatility may increase in the near term.

DISRUPTIVE ROLES ARE GETTING MORE TRACTION WITHIN TECH

Source: LPL Research, National Bureau of Economic Research Working Paper #28999, 06/24/24

2https://economics.mit.edu/sites/default/files/2022-11/ACSS-NewFrontiers-20220814.pdf

CONCLUSION

Excitement — plus maybe some “irrational exuberance” — on artificial intelligence and other disruptive technologies generated several record highs for the major stock market indexes over the past week and pushed implied volatility to historical lows. Despite the call to “buckle up” and have a prudent plan for volatility, the impact on research and development spending can persist for years. For those long-term investors willing to look past near-term uncertainty and elevated — but not bubble-like — valuations, the role of disruptive technologies might turn out to be the antidote to the headwinds of today.

ASSET ALLOCATION VIEWS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. Steady economic and earnings growth this year has kept the risk-reward trade-off for stocks and bonds fairly well balanced, but moving forward, with valuations for stocks elevated and bonds offering more attractive yields, we believe bonds hold a slight edge over stocks. Strong year-to-date stock market gains may have pulled forward some potential gains from Fed rate cuts, potentially leaving limited upside and more volatility over the balance of 2024 as the economy potentially slows.

Within equities, the STAAC continues to favor domestic equities over international in its Tactical Asset Allocation (TAA), with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee recommends a very modest tilt toward the growth style after reducing its overweight position in mid-March. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001329-0524 | For Public Use | Tracking # 594599 (Exp. 06/2025)